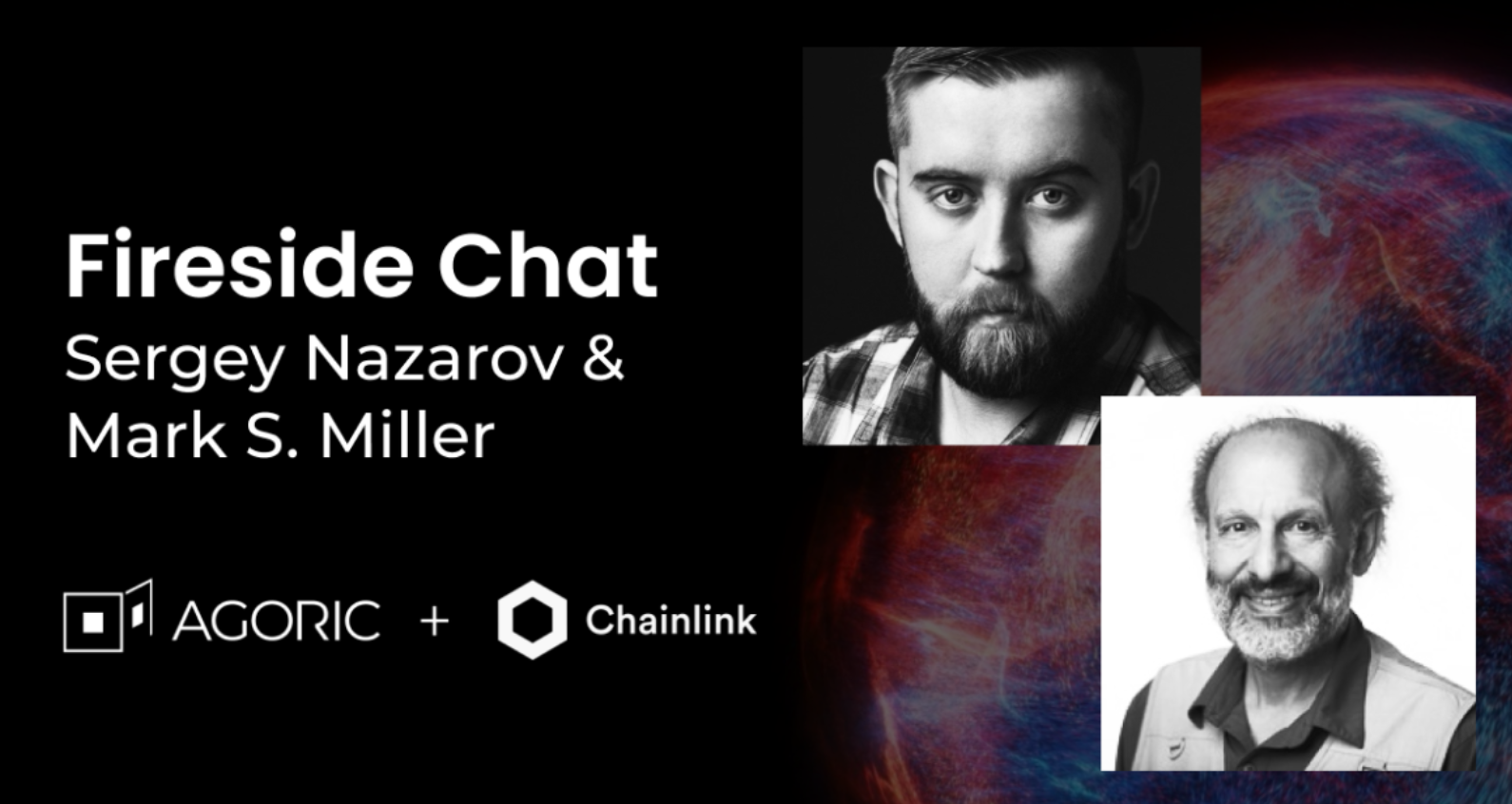

Greetings from the Agoric crew, fresh from our Hack The Orb hackathon. We’ve got our monthly community call coming up this Wednesday, December 2, at 9am Pacific, and you can (re)watch the November 6 fireside chat between Chainlink CEO Sergey Nazarov and Agoric Chief Scientist Mark S. Miller.

In addition to our ongoing development effort toward a mainnet release in early 2021, much of November was dedicated to our latest hackathon, Hack the Orb. Combining forces with the team at Chainlink, Hack The Orb brought market-leading oracles to Agoric’s secure JavaScript smart contract platform. Over the two-week hacking period (November 6 – 21), attendees built dapps on Agoric.

Hack The Orb partners included CryptoChicks, Lemniscap, DeFiprime, Outlier Ventures, and Rockaway Blockchain Fund. We also had a wonderful roster of judges, including Zaki Manian, Miko Matsumura, Lauren Stephanian, Baek Kim, and Keenan Olsen.

. . .

Updates: What’s Happening at Agoric

Engineering News

Completed the Chainlink integration in preparation for HackTheOrb, allowing developers to connect to external data feeds.

Added a loan contract example demonstrating an application where borrowers can add collateral to receive a loan, with asset prices served via Chainlink oracle.

Added a call spread contract example that acts as a key DeFi primitive for developers who want to build options, futures, or prediction market applications.

Updated agoric-sdk and testnet to Stargate rc3.

Met with ECMA TC-39 to drive standards progress around JSON modules, module blocks, and error cause properties.

The Agoric “SwingSet” kernel now enables vats to create “virtual objects,” whose contents live on disk, not RAM, enabling greater scalability for numerous objects like Purses, Payments, and contract Offers.

Follow our engineering news at https://agoric.com/weekly-updates/.

Agoric Tutorial, Workshop, and Talk Videos

Over the course of November, throughout our Hack The Orb hackathon, we uploaded more than two dozen videos to our youtube.com/agoric channel. If you’re wondering which to check out first, we recommend (1) Joe Clark from RMIT University explaining how call spread is a fundamental unit of finance, and how it relates to other important derivatives, (2) Agoric CEO Dean Tribble on DeFi governance and how it works on Agoric, and (3) Agoric economist Bill Tulloh on stablecoin economics.

Founders of Web3: Making Smart Contracts Secure & Usable at Scale

Agoric Chief Scientist Mark S. Miller was interviewed by Outlier Ventures for its podcast: “We talk to one of the legendary founding fathers of the internet Mark Miller, about his 40+ year career as leading researcher at Xerox PARC, Google, Xanadu, core contributor to JavaScript and creator of the ‘E’ Language. We discuss how he was inspired in the 80s by the economist Hayek’s ‘utility of property rights’ and object oriented programming to found Agorics (in ‘94) to create secure distributed computing markets to lower the risk of cooperation. We also discuss the history of smart contracts, and why in 2018 he rebirthed Agorics as Agoric to make smart contracts more secure, and accessible to developers.” https://outlierventures.podbean.com/e/making-smart-contracts-secure-usable-at-scale-with-mark-miller-of-agoric/

The Decentralized Justice Broadcast

Agoric engineer Kate Sills spoke about computer science, libertarianism, building novel institutions, and tiny houses. https://decentralizedjustice.podbean.com/e/episode-5-kate-sills-agoric/

. . .

Events: Events in Which We’re Participating

All scheduled events are, for the time being, taking place remotely.

Agoric Monthly Community Call: Dec 2, 9am PT

Interchain Conversations: December 12-13 Agoric CEO Dean Tribble will speak about the Agoric Public Chain and Economy on December 12, 6pm PT

Keep track at agoric.com/events.

. . .

Bookmarks: What We’re Reading

Toward a Fully Continuous Exchange

The success of automated market makers (AMM) and the challenge of miner extractable value (MEV) demonstrate the importance of market design for DeFi. We are in the early days of discovering what works best. One place to look for ideas is in the design of traditional financial markets. This article proposes a new market design: continuous scaled limit orders, where orders to buy and sell represent flows of shares over time. (Tulloh) https://ssrn.com/abstract=2924640

Ten Stablecoin Predictions and Their Monetary Policy Implications

The keynote address for Cato’s Monetary Policy conference talked about stablecoins and their implications for monetary policy. Should be of interest to people thinking about how to integrate stablecoins into an economy or into the economy. Here’s the link to the conference, which includes videos of all the talks. (Hibbert) https://www.cato.org/events/38th-annual-monetary-conference/

. . .

Thanks for Reading and Sharing

Please feel free to forward. You can join the Agoric community on Twitter, Telegram, Discord and LinkedIn, subscribe to this monthly newsletter, and catch us at upcoming events.