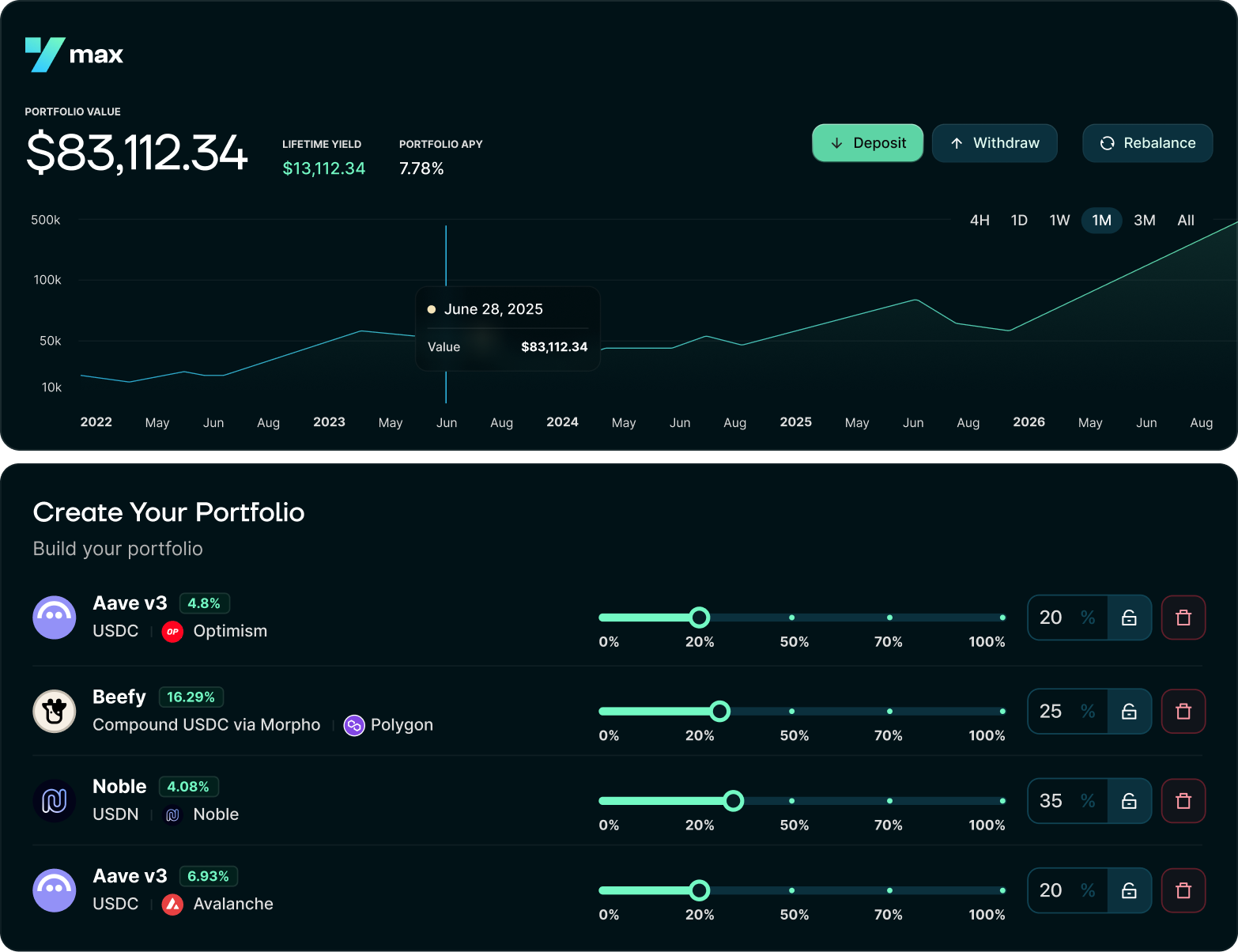

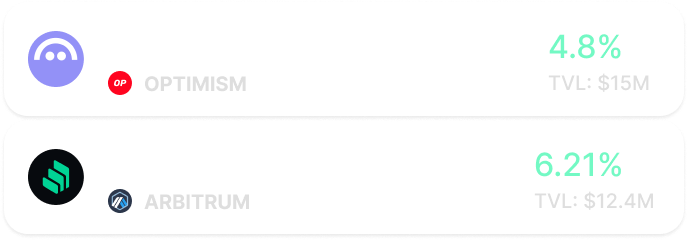

Your capital,

orchestrated.

The cross chain DeFi command center that moves, allocates, and rebalances your stablecoin portfolio with one signature.

Save time and capture more yield by automating moves across chains and protocols.

Run every strategy from one place. Any chain. One signature.

Built on Agoric Orchestration and Fast USDC for speed, security, and reach.

How it works

Connect wallet and fund with USDC.

Connect wallet and fund with USDC.

Choose targets and risk controls.

Choose targets and risk controls.

Approve once.

Ymax orchestrates moves over time using Agoric Orchestration.

What Ymax does

Core Benefits

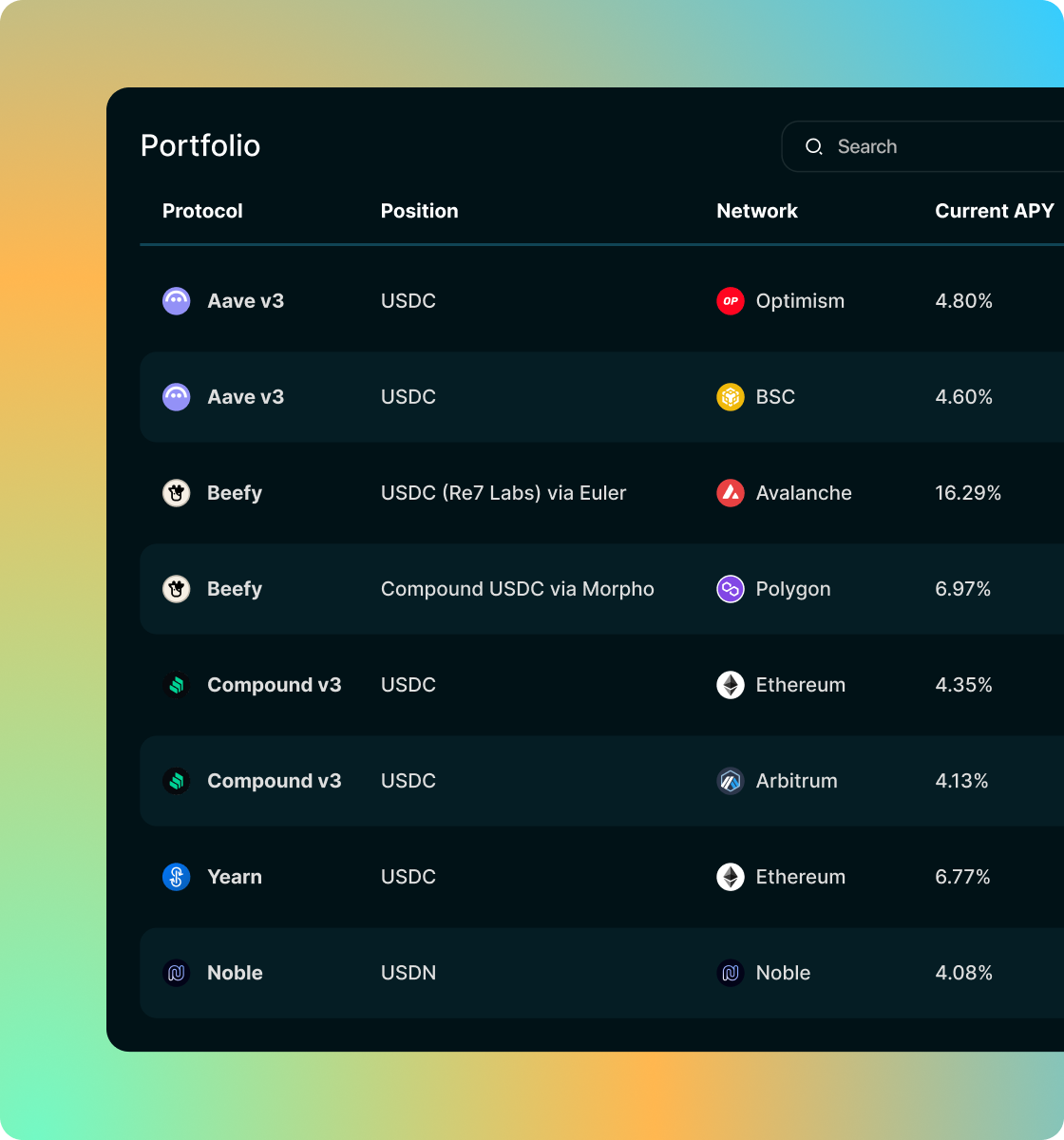

Seamless aggregation

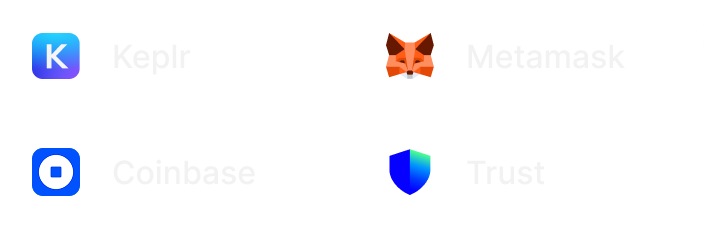

Positions, yields, and execution across chains and protocols in a single, actionable view.

One-Signature speed

Preview and execute entire multi-step strategies end-to-end with one signature instead of dozens.

AI co-pilot intelligence

Act with confidence with intelligent assistance to highlight opportunities.

Non-custodial security

Assets stay in your wallet at all times and every action is transparent, previewable, and auditable.

Compound

Aave

Morpho

Blue Chip Protocols

Orchestration Flow

Discover Opportunities

on Protocols 5; Vaults 13

Deploy with OneSig

Across complex cross-chain flows

Maximize your Yield

Ymax does the work for you

What Only Ymax Can Do

What Only Ymax Can Do

Thanks to multi-block execution, One sig triggers multi-step processes (e.g., rebalancing Aave/Compound/Yearn), leveraging async mechanisms to execute intent-based logic efficiently.

Async Multi-Block Execution

Orchestration runs long-lived smart contracts with smooth multi-chain timers to execute actions at the perfect time. No delays.

On-Chain Timers for Perfect Timing

Advanced orchestration capabilities to schedule auto-harvests, rebalancing, and auto compounding exactly when needed.

Fast Liquidity Rails

Fast Liquidity Rails

Safe Cross-Chain Moves

Move capital between blockchains fast and secure, protected by top-notch security that's been battle-tested in traditional finance.

Seamless cross-chain communication

Ymax leverages Circle's CCTP, Cosmos IBC and Axelar' General Message Passing to make stables transactions seamless across any blockchains. So bridges and wrapped tokens shouldn't concern you.

Ymax is a non-custodial, cross-chain capital management app that lets users seamlessly execute multi-step DeFi strategies with a single signature.

Right now Ymax supports vaults on Ethereum Layer 1 and Layer 2s including Arbitrum, Base, and Optimisim, Avalanche, and IBC-enabled chains.

Actions like withdrawing from one protocol, bridging to another chain, depositing into a new vault, and updating portfolio positions, or even rebalancing allocations across multiple vaults can all be executed as one coordinated workflow.

No. Ymax is fully non-custodial. Nothing happens without your explicit approval, and every step is previewed and recorded so you can see exactly what occurred.

Ymax is designed for DeFi power users and capital operators who manage meaningful size and want faster, safer execution across chains without juggling multiple tools. In practice, Ymax is for anyone who wants to take the stress out of cross-chain capital management.