Bill Tulloh: Please explain to us how Zoe has the power to be of use in modeling experimental economic systems.

Kevin McCabe: Oh yeah, for sure. I’ll mention just a little bit of background. A number of years ago, when I first started doing the experiments, we were doing something called smart markets. Smart markets were an attempt to put computer intelligence into the way contracts were formed, marketplaces where you have different traders, and we thought this would apply largely to complicated markets, markets where how you order contracts and how you decide to make allocations from what people are bidding and asking and so on would be very difficult.

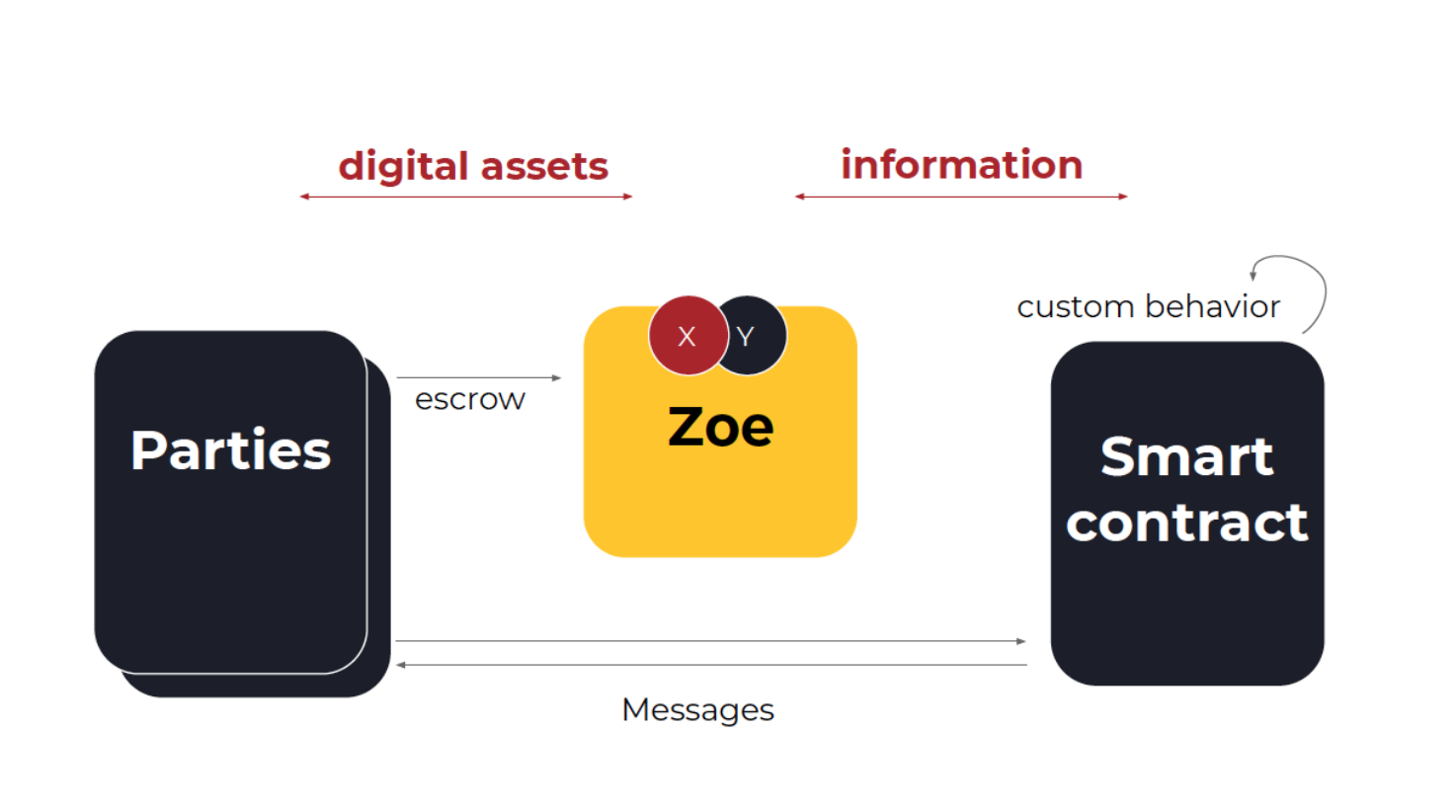

Since then that’s grown into a fairly big enterprise and people now do a lot of the smart market building, but what’s been largely ignored — well, not ignored, but handled differently is the smart contracting that would support smart markets. Zoe allows us to build these contract templates in such a way that decentralized property rights are protected. It takes the problem away from the institution, the smart market, and makes it easy to experiment with and manipulate the rules of the smart market.

Tulloh: How does Zoe fit into that activity?

McCabe: We had a nice conversation with Mark Miller, and in that discussion it became clear that some of the auction parts of the process may still be owned by a single player who’s running it on their computer system and then using Zoe to guarantee that the message space that people are using in their contract mechanism can be trusted by people to follow through on the messages that they’re providing. That is new. The whole follow-through fulfillment side has always been seen as a completely separate piece of the market — with the New York Stock Exchange, you trade and then you go to basically fulfillment centers, they’re called clearinghouses, but then the contract gets executed completely independently.

I hadn’t thought about this before, something else that Mark said, and it’s a good point: You might build an institution, but why would you trust it? Why do I trust the Amazon fulfillment process, for example? Traditionally, companies build trust with consumers slowly through reputation and use, and this can be very difficult for a small company or a startup, anyone on a small budget. One of the uses of Zoe is to ensure the institution will follow the rules, and not change them in ways I don’t expect. That ability to build trust in the institution, by having Zoe embedded in it, makes it a very useful tool that I imagine will create widespread adoption once it is fully developed.

Tulloh: You mentioned the work done on smart computer–assisted markets, because this was part of the pioneering effort in smart contracts. Could you discuss that early history more?

McCabe: Yeah, it’s a really interesting early history. I didn’t get to Arizona until ’85, but Steve Rassenti working with Vernon Smith had written a dissertation on a smart market for airline deregulation of airplane landing slots. As far as I know, this is the first example of a market where they’re trying to have the computers solve the numerical problem of how to allocate all these slots against the value of the slot, which is determined by what people are willing to bid for them. And even then, I’m pretty sure Vernon and Steve had this idea that what people really understand at any point is their own circumstances of time and place.

We began working on natural gas markets and electricity markets, and it was very eye-opening for me. There’s this whole idea that you can decentralize where the information’s coming from, but centralize what you’re going to do with the information, and that completely changed the way I thought about markets. It’s become a big business now. People are using it for everything from how to fill up a cargo airplane to how to route trains through congestion points, so it’s pretty amazing.

Tulloh: How might smart contracts change smart markets?

McCabe: The whole idea of running a smart market has now become commodified. People are willing to pay a lot to learn how to build smart markets. When Uber gets a ride to your front door, that’s a smart market operating.

But I do think one thing that was different is that when we ran our smart markets, we assumed a well-working property right system. We just assumed, and the way we did that in practice when we ran our experiment is we guaranteed everything. You contracted for gas to be delivered to your site. Well, gas got delivered to your site. Now, we didn’t physically deliver any gas, but the monetary value of it got credited to your account with no problems at all. So we did all the fulfillment for people because we were more interested in the price discovery process, how well these markets work, finding the right prices and all this kind of stuff.