“My strategy was solid. The execution was chaos.”

Ever been there?

You passed on a higher-yield opportunity because bridging, entering, and exiting positions across protocols and networks was just too much work.

Your portfolio tracker shows your positions — but cannot help you act on them.

Automated strategies and agents feel like a black box - you want help, not autopilot.

You think you’re stuck, but you’re just constrained by your tools.

DeFi promises open access. But instead, it delivers friction.

For years, we’ve watched DeFi users operate like elite traders in a war zone of chains, vaults, dashboards, wallets, bridges, bots, and broken UX. Even the most advanced users still face systemic blockers: the protocols are fragmented, manual, and confusing; to deploy capital across chains, users jump through tens of apps, bridges, and approvals; they spend hours managing their portfolios and struggle to react fast enough to capture the best yield. What was supposed to be composable is just chaotic.

At Agoric, we come from the infrastructure trenches. We’ve shipped orchestration tech to help people navigate the chaos between networks. We’ve helped solve liquidity flows across chains. We’ve watched as DeFi users hit the same wall: complexity that kills execution. Now we’re confronting that problem head-on.

Ymax, your cross-chain DeFi command center, is entering private beta — and the waitlist opens today.

Why Now: DeFi Power Users Are Burnt Out

We built Ymax for all those DeFi users who want control, speed, and strategic clarity without sacrificing transparency. They’re running strategies across chains, juggling dashboards, and watching yield windows close before they can act. And like many, they’re not short on knowledge, just short on time.

If you’ve ever moved capital across Ethereum, Arbitrum, Base and Cosmos chains in a single session, you already know the problem isn’t finding yield. It’s orchestration. When you’re hopping between interfaces, spreadsheets, Telegram alpha groups and setting reminders to lock in a position, you know the problem is the execution.

“I Don’t Need Another Tool. I Need a Command Center.”

For those users in need of a capital command center we introduced Ymax. A single place to plan, execute, and automate yield across all ecosystems. Something built for capital operators, not developers.

That’s the Ymax vision.

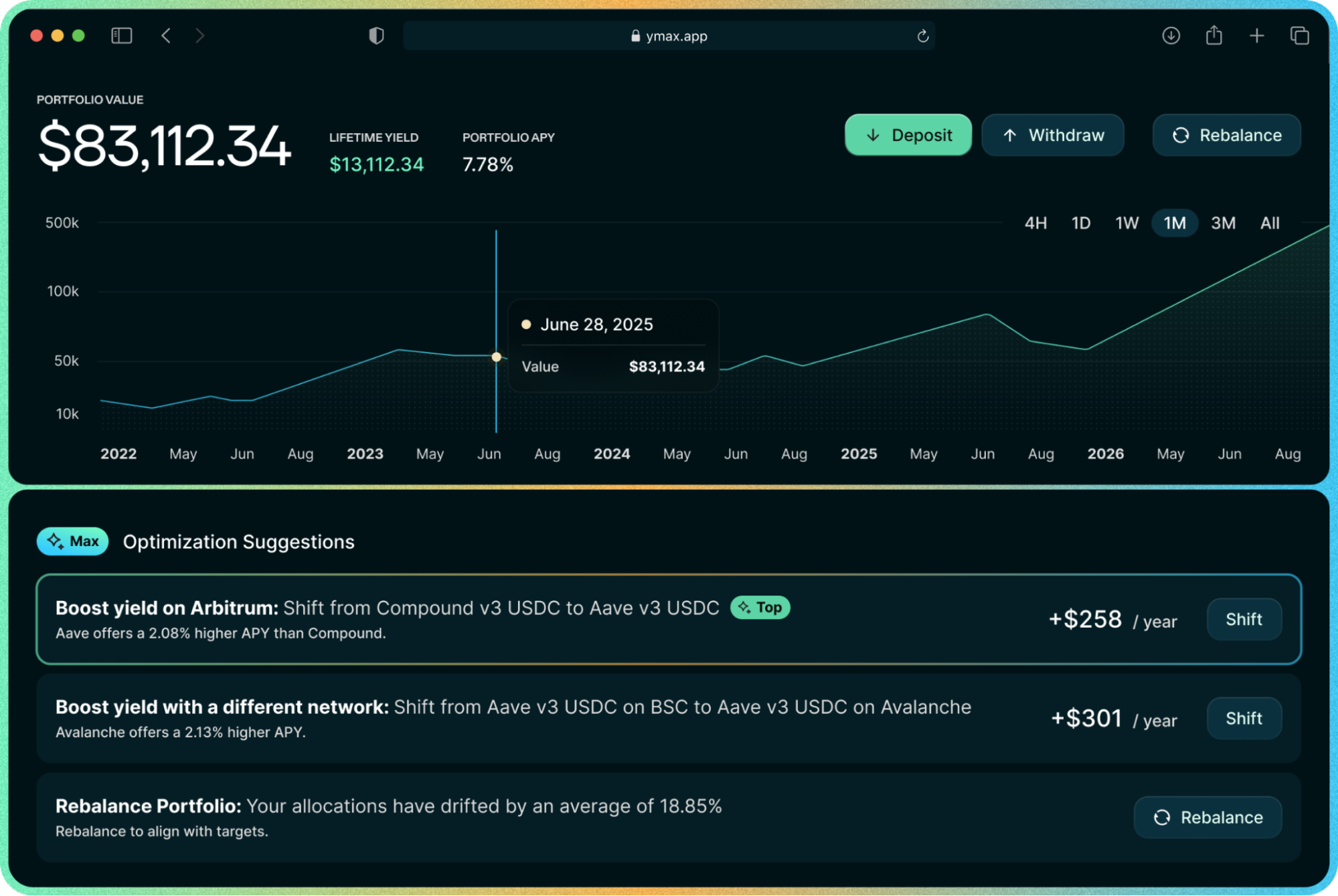

Simulated development image, final product may vary.

Designed for strategy, built for scale, and engineered for control, these are the features of the Ymax experience:

OneSig: Single-signature execution of complex, cross-chain yield strategies (bridge, optimize, rebalance).

AI assistant: To guide yield optimization discovery across any DeFi ecosystem.

Transparent, non-custodial execution. Every action is verifiable, every flow user-approved. You trigger, approve or deny. Automate but keep control.

Unified portfolio view of assets and positions across chains and protocols.

The Private Beta is open to qualified users who understand DeFi risks and want to test a new paradigm of on-chain coordination (Beta software may have bugs; always DYOR).

If that sounds like you, we’d like you on board.

One Signature. Every Chain. Any Strategy

Ymax is being built to make the most advanced DeFi operations feel seamless.

Say you want to move $50K from Aave on Ethereum to higher yields on Base and Arbitrum. Today, for many users this manual process takes six-seven steps, half an hour, and constant monitoring just to move funds across chains. With Ymax, you review the suggested strategy, sign once, and the entire flow executes automatically - funding, bridging, swapping, and rebalancing. Every step is visible. Every action is user-approved.

And you only sign once!

What Makes Ymax Different

If Zapper shows your balances, Beefy aggregates yield vaults, and SingularityDAO hands out control to AI, then Ymax is what happens when you stay in charge.

You define intent. Ymax executes. Unlike dashboards, Ymax is not a passive platform and execution is built in. Unlike vaults, we’re not opaque. You see every move. You approve every new position. Unlike AI agents, we don’t ask you for your keys. You stay in control.

Whether you’re optimizing stablecoin yield, rebalancing LP positions, or testing new strategies across chains, Ymax turns multi-step workflows into one coherent action that's fast, reliable, and fully visible.

What’s Next: Beta and Beyond

For Ymax, the north star is simple: DeFi should feel like capital command & control, not software configuration. The Ymax roadmap focuses on turning automation into orchestration.

Upcoming features include:

Broad coverage to all major ecosystems.

Smart Automation – intent-driven rebalancing that acts only within your defined parameters.

Expanded coverage – to top stables, RWAs and other use cases like staking, lending, yield vaults.

Try Ymax now

If you’ve ever wished DeFi worked the way you think, join the Ymax Private Beta.

We’re inviting 500 serious users to help test, shape, and refine the platform before its public release.

Shoutout to the early testers who've been shaping Ymax from day one. And to our partners at Axelar, Circle, and across the Agoric ecosystem - this is just the beginning.