DeFi has become multi-chain, but execution hasn’t kept up. Most users still move capital the same way they did years ago—bridging assets manually, confirming every step, juggling dashboards, and hoping nothing breaks on the way. The tools have gotten better, but the workflows haven’t.

Ymax changes this by introducing orchestration: a way for long-running, cross-chain smart contract workflows to execute from a single signature, with full auditability and no loss of user control.

This post explains how Ymax works under the hood and why this architecture is fundamentally different from aggregators, smart wallets, bots, or batching tools.

Why Ymax Needed a New Architecture

Today’s DeFi tools are limited by a core constraint: blockchains don’t execute long-form workflows. They process one transaction at a time. Anything more complex—bridging, waiting for confirmations, responding to changing states—must be stitched together manually or pushed off-chain to bots and scripts.

That’s why most platforms hit one of two walls:

1. They can support advanced operations, but only on a single chain or ecosystem.

These systems go deep but not wide. They rely on atomic batches or intricate local flows and struggle to extend this experience across ecosystems.

2. They can go multi-chain, but only by simplifying the user experience.

Aggregators that “go wide” drop almost all complexity. They can show opportunities but can’t coordinate multi-step execution. Ymax eliminates this tradeoff. Its orchestration layer allows complex, asynchronous workflows to span chains, blocks, and time while preserving a unified, single-signature UX.

The Ymax Architecture

Ymax is built from four components that work together as a true execution engine, not a router or interface. The portfolio contract, Orchestration layer, cross-chain integrations (like Axelar), and modular protocol adapters.

1. The Portfolio Contract (Agoric)

The Portfolio Contract serves as a user account’s entry point and the authoritative source of truth for all portfolio activity. It stores the user’s portfolio object, tracks allocations, weights, and positions, and initiates every outbound cross-chain call. The contract coordinates deposits, withdrawals, and rebalances from start to finish while enforcing access through per-user capability tokens. At no point does it take custody of funds; assets always move directly between the user’s wallet and the underlying protocol vaults, never into a shared Ymax pool. This contract is the “brain” of the system, governing every action with transparency and capability-based security.

2. Agoric Orchestration: The Core Differentiator

Agoric Orchestration is what makes Ymax technically distinct from other DeFi platforms. It enables long-running workflows that persist across blocks, asynchronous execution that waits for events and confirmations, and built-in timers, retries, and recovery without user intervention. These workflows can coordinate multi-block, multi-chain activity while operating entirely from a single user signature. When a user signs an instruction such as “rebalance my portfolio,” the signature authorizes the entire workflow rather than the individual steps. The orchestrator then withdraws from the source protocol, waits for the withdrawal to finalize, bridges the assets, waits for the bridge to settle, deposits into the destination protocol, and records the updated allocations. If the bridge is slow, the system simply waits; if gas spikes, it retries on the next block; if something fails, it halts safely and reports the exact location of the funds. This type of execution cannot be achieved with batch transactions, smart wallets, or front-end bots, which cannot span blocks, wait asynchronously, or run workflows natively on-chain.

3. Cross-Chain Transport

During the Beta period, Ymax uses tech like Axelar GMP and Circle’s CCTP to handle cross-chain transport, including programmatic bridging, secure message passing, confirmation reporting, and returning receipts to the portfolio contract. These Axelar calls occur entirely within the orchestrated workflow, meaning the cross-chain steps are not handled manually by the user or by off-chain automation. They are formal components of the contract logic, executed deterministically as part of the workflow’s progression.

4. Protocol Adapters (Modular, Extensible)

Protocol adapters give Ymax its modular reach by translating high-level portfolio instructions into the specific operations required by each protocol. The Ymax Beta includes adapters for Aave V3 and Compound V3 on EVM chains with more assets and positions on the way. Each adapter presents a consistent interface to the orchestration engine regardless of differences in chain architecture, vault mechanics, or token behaviors. This design ensures that as new protocols are introduced, the user experience remains unchanged, offering the same unified workflow, single signature, and seamless interactions across supported positions.

Why This Architecture Is Unique

Ymax operates differently from every category of DeFi tooling in use today as a true Command Center. It is not a batch transaction system, because batches execute once and cannot pause for confirmations, bridge receipts, or asynchronous events, whereas Ymax workflows persist across blocks and unfold over time. It is not a smart wallet, since smart wallets still function on a single chain and cannot run long-lived, cross-chain processes. It is also not a bot or automation script; bots generally operate off-chain, lack state guarantees, and fail easily, while Ymax executes deterministically on-chain with built-in reliability. And it is different from traditional yield aggregators, which pool user funds and rebalance a shared vault, while Ymax orchestrates each user’s own assets, in their own wallet, under their own signature.

How Orchestrated Workflows Execute

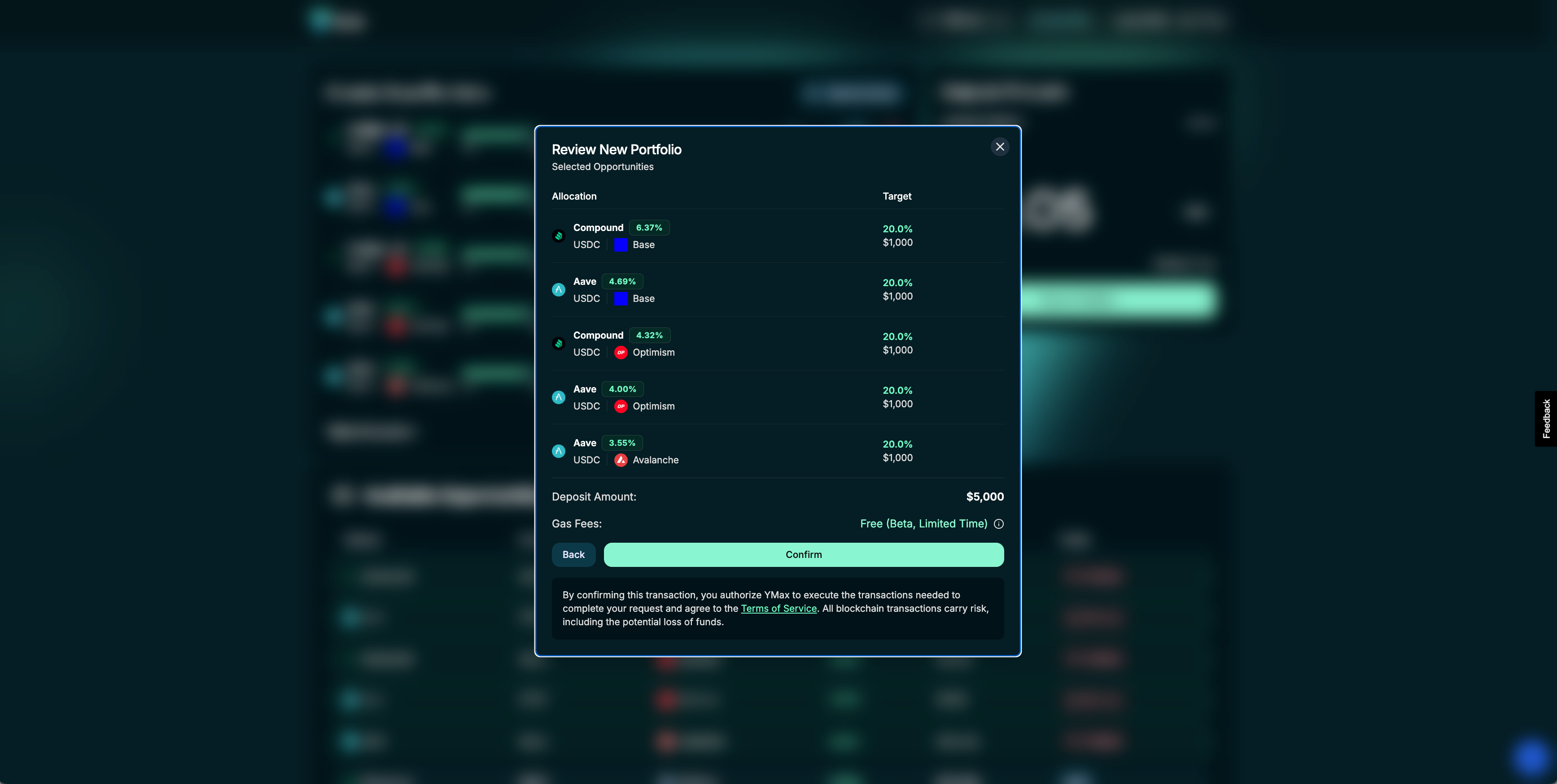

When a workflow executes on-chain, each step unfolds as part of a long-lived, asynchronous process. It begins with portfolio creation: the user selects their asset distribution across positions in the Ymax app, signs once, and the system creates a portfolio and stores the user’s target allocations. This portfolio becomes a durable container that persists across blocks and serves as the foundation for the user’s cross-chain strategy.

Depositing USDC follows a similar pattern. The user signs the deposit, the portfolio contract receives the funds on Agoric, and the contract determines whether the USDC should be used locally or bridged via CCTP to a target chain. Once the decision is made, the workflow proceeds automatically without further user involvement.

Moving assets across protocols is where the benefits of orchestration become fully visible. A single signature initiates all the necessary actions in sequence: withdrawals from positions, approvals, bridging steps, protocol deposits, confirmation tracking, and updates to the user’s recorded positions. Each of these actions continues across multiple blocks, waiting for finality before advancing to the next stage.

Simulated development image, final product may vary.

Rebalancing follows the same orchestrated model. The workflow pulls funds from current positions, bridges as required, deposits them into newly selected targets, and updates the portfolio’s distribution which is then reflected in the dashboard. All of this occurs from one user signature, unfolding as a series of asynchronous steps that the system completes to finality.

Withdrawals work the same way: the user requests a specific amount, and the workflow unwinds the necessary positions, waits for protocol confirmations, bridges assets back to Agoric, and returns stablecoins to the user’s wallet. Throughout the entire process, assets remain in user-controlled locations and never rely on batching tricks or off-chain bots.

Your Capital. Orchestrated.

Ymax is a full execution engine built for multi-chain DeFi. By running long-lived workflows entirely on-chain through Agoric Orchestration, it transforms today’s fragmented, multi-step operations into deterministic, single-signature processes. The portfolio contract encodes the user’s intent and governs every action, the orchestration layer carries those actions across time and across chains, Axelar handles the transport of assets and messages, and protocol adapters provide modular access to each integrated platform. Throughout the process, execution remains non-custodial, auditable, and reliable. The result is a system that makes multi-chain DeFi feel unified rather than scattered, a true command center for capital.

If you want to follow the project as it evolves, follow @Ymaxapp on X and join the waitlist to be among the first to get hands-on with the application.